Table Of Content

FHA loans are insured by the Federal Housing Administration and issued by approved lenders. They’re intended for homebuyers with low income or those unable to qualify for a conventional loan. Mortgages are secured loans, and your home acts as collateral. This means your lender has the right to seize the property—through an act known as foreclosure—if you default on your payments. Additionally, Mello Smartloan can digitally conduct title search and clearance, which is often one of the more time-intensive steps of the loan underwriting process.

How To Get a Mortgage & Steps to Take Before Applying

This right allows the homeowner to buy the property back up to one year after the auction. However, with a judicial foreclosure, a lender can get a deficiency judgement which allows the lender to pursue the full mortgage amount from the borrower. The FHFA limit for 2023 is $726,200, meaning you can use a jumbo loan to purchase a home worth more than that in many parts of the country. Borrowers who use its Mello Smartloan technology can shorten the closing process by up to 17 days. Borrowers can apply online or in person at one of more than 2,500 branch locations.

Local Economic Factors in California

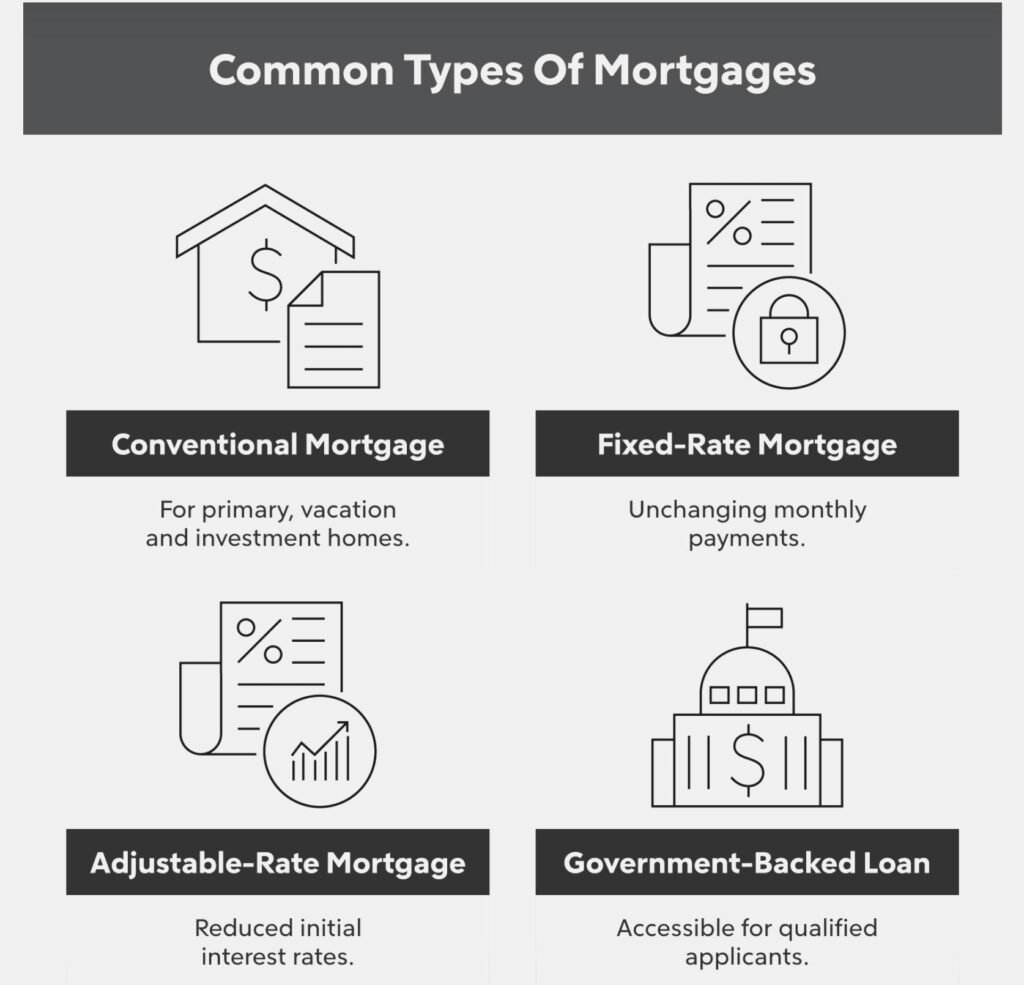

With a fixed-rate mortgage, the rate will be consistent for the duration of the loan. With an adjustable-rate mortgage (ARM), the interest rate can fluctuate with the market. After getting a mortgage, you’ll typically receive an amortization schedule, which shows your payment schedule over the life of the loan. It also indicates how much of each payment goes toward the principal balance versus the interest. Rates on new home loans now far surpass rates locked in by Americans with existing mortgages.

California Housing Market

The main benefit of FHA loans is that they have less stringent qualification requirements than conventional loans. Borrowers with a credit score of at least 580 can qualify with a down payment as low as 3.5%. If you have enough to put down at least 10%, you can qualify with a credit score as low as 500.

How to find the best mortgage lender in California

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you don’t have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time won’t show up on your credit report as it’s usually counted as one query. Wells Fargo offers several low down payment options, including conventional loans (those not backed by a government agency).

The latest uptick brings it to its highest level since November 30, when it was 7.22%. The average rate on a 30-year mortgage rose to 7.17% from 7.1% last week, mortgage buyer Freddie Mac said Thursday. Be sure to check for additional programs in different regions and counties across California. In some cases, these local programs might be open to both first-time and repeat homebuyers. Check out Bankrate’s county-by-county listing of conforming loan limits in California to see what applies to you. Mortgage rates rose throughout 2023 but are expected to drop in 2024.

Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. Your calendar is as varied as the city itself, with endless entertainment options—premieres, concerts, festivals, and more. And yet, the natural beauty is never far, with hikes in the Santa Monica Mountains offering sweeping views of the cityscape and the Pacific.

Home Loans For Bad Credit 7 Loan Options For 2024 - The Mortgage Reports

Home Loans For Bad Credit 7 Loan Options For 2024.

Posted: Wed, 17 Apr 2024 07:00:00 GMT [source]

California has had a slow recovery from the recession compounded by a lack of affordable housing. The state has some of the highest median home values in the country, as well as a high cost of living. You should also work on saving for a down payment—the more you save, the less you have to borrow. And avoid making any big life changes like switching jobs or taking on additional credit before your home purchase is complete. The first step to finding out how much house you can afford is determining your budget.

Unlike the bank, the lender answered their questions and helped calculate their mortgage payments with current interest rates. The average 30-year fixed mortgage interest rate is 7.30%, which is an increase of 18 basis points from one week ago. (A basis point is equivalent to 0.01%.) A 30-year fixed mortgage is the most common loan term.

Getting a mortgage should always depend on your financial situation and long-term goals. The most important thing is to make a budget and try to stay within your means. CNET’s mortgage calculator below can help homebuyers prepare for monthly mortgage payments. Many people start by determining what they can afford as a monthly payment. A common starting point is to calculate 25% of your gross monthly income to help determine a manageable monthly mortgage payment.

In turn, interest rates for home loans tend to increase as lenders pass on the higher borrowing costs to consumers. The Golden State has a non-judicial (no courthouse involvement) process for deeds of trust that include a power-of-sale clause and a judicial process for mortgages. However, the most common foreclosure in the state is non-judicial, which generally means a speedier process. When a lender includes a power-of-sale clause, the lender trades a full loan payout for timeliness. This means a lender can’t collect a deficiency judgement against the homeowner.

The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

No comments:

Post a Comment